Beelinguapp Review: Excellent Reading-based Learning App, But Not for Beginners

Do you wish that you could read “The Hunchback of Notre Dame” in the original French or Haruki Murakami novels …

Do you wish that you could read “The Hunchback of Notre Dame” in the original French or Haruki Murakami novels …

There are plenty of unique ways to learn a language, like watching movies and playing games.

But sometimes, a …

You may think flashcards are “old school,” but they’re neither dull nor dated.

Flashcard apps are a language learner’s best …

The magic of flying can captivate anyone.

The view. The eerie excitement of crossing a large body of water. The …

Do you dream of hiking Machu Picchu in Peru?

Or maybe you’d rather relax on a Colombian beach or …

Is there anything more freeing or empowering than traveling alone to a new place?

While solo trips are wonderful ways …

These seven best free translator tools are chock-full of features, great translations and quality that’s hard to match.

Some even …

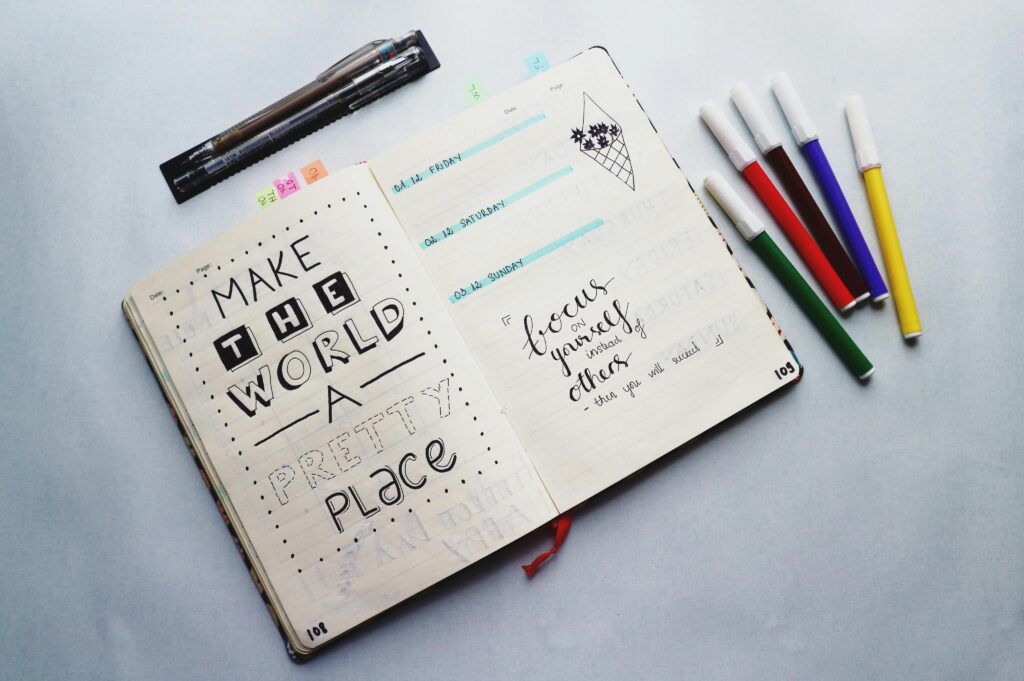

I’ve got a secret.

There’s a new BFF for language learners—a method to intensify, organize and customize language learning.

Bullet …

Do you need to learn to roll your Rs for a language you’re studying, but feel like the technique …

Fluent in Three Months Premium is a language learning program that focuses on language hacks, tips and techniques that have …