20 English Words for Finance

News of the United Kingdom leaving the European Union surprised the whole world.

Financial news sources can’t stop talking about how this will affect the global economy.

“Stocks Tumble After Brexit Decision, Marking Largest Loss Since August”

“Brexit Vote Sends Shock Waves Through Global Financial Markets”

Even though the news came out a while ago, it shows how important it is for anyone in business to know financial vocabulary.

Contents

- 3 Quick Tips for Increasing Your Financial Vocabulary

- The Top 20 Business English Words for Finance Topics You Must Know

- And One More Thing...

Download: This blog post is available as a convenient and portable PDF that you can take anywhere. Click here to get a copy. (Download)

3 Quick Tips for Increasing Your Financial Vocabulary

1. Make the Business Section Your Friend

Most major news websites have a Business Section featuring business news stories. This is the best place to keep up with the latest financial news, both local and international, and improve your financial vocabulary and language usage at the same time.

2. Sit Down with a Good Finance Book

Get your hands on a good finance book.

Forbes‘ top 10 personal finance books is a great place to start finding one that works for you. This list includes many popular titles, like:

- “The Millionaire Next Door” by Thomas J. Stanley and William D. Danko

- “Why Didn’t They Teach Me This in School?: 99 Personal Money Management Principles to Live By” by Cary Siegel

The best part is that many of these are written for people who don’t know about finance, so they’re quite fun and easy to read—and they explain finance terms clearly.

3. Note the Use of Financial Language at Work

Be sure to note down any new financial language you encounter while you’re at work.

Set yourself the goal to learn five new words a day from this list, and you’ll be on your way to improving your financial vocabulary very quickly.

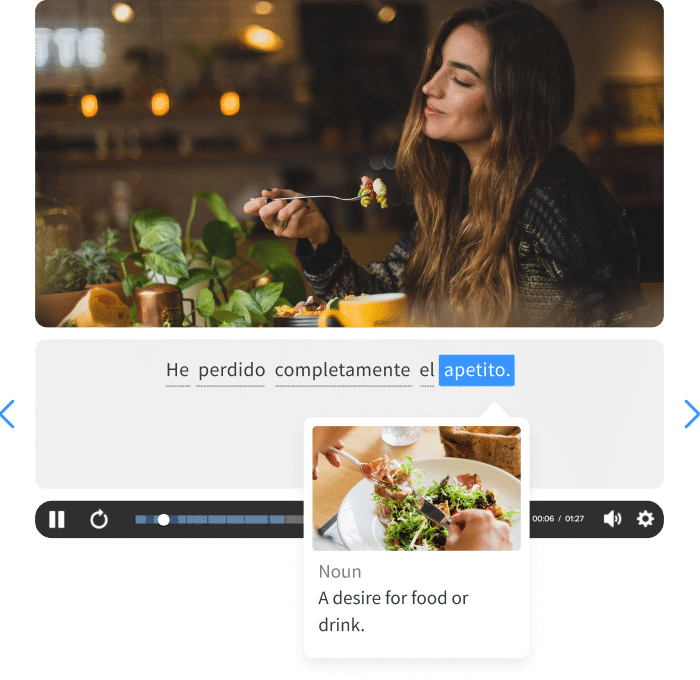

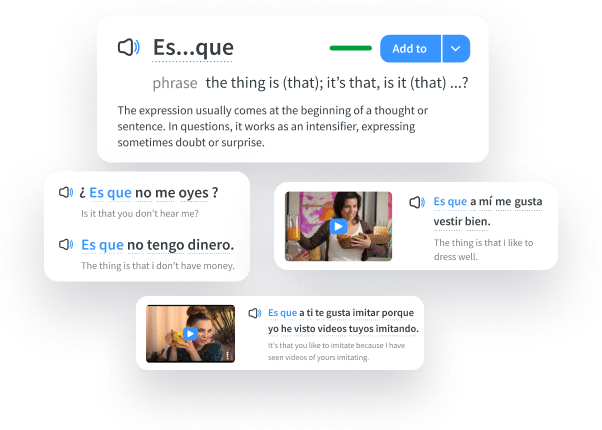

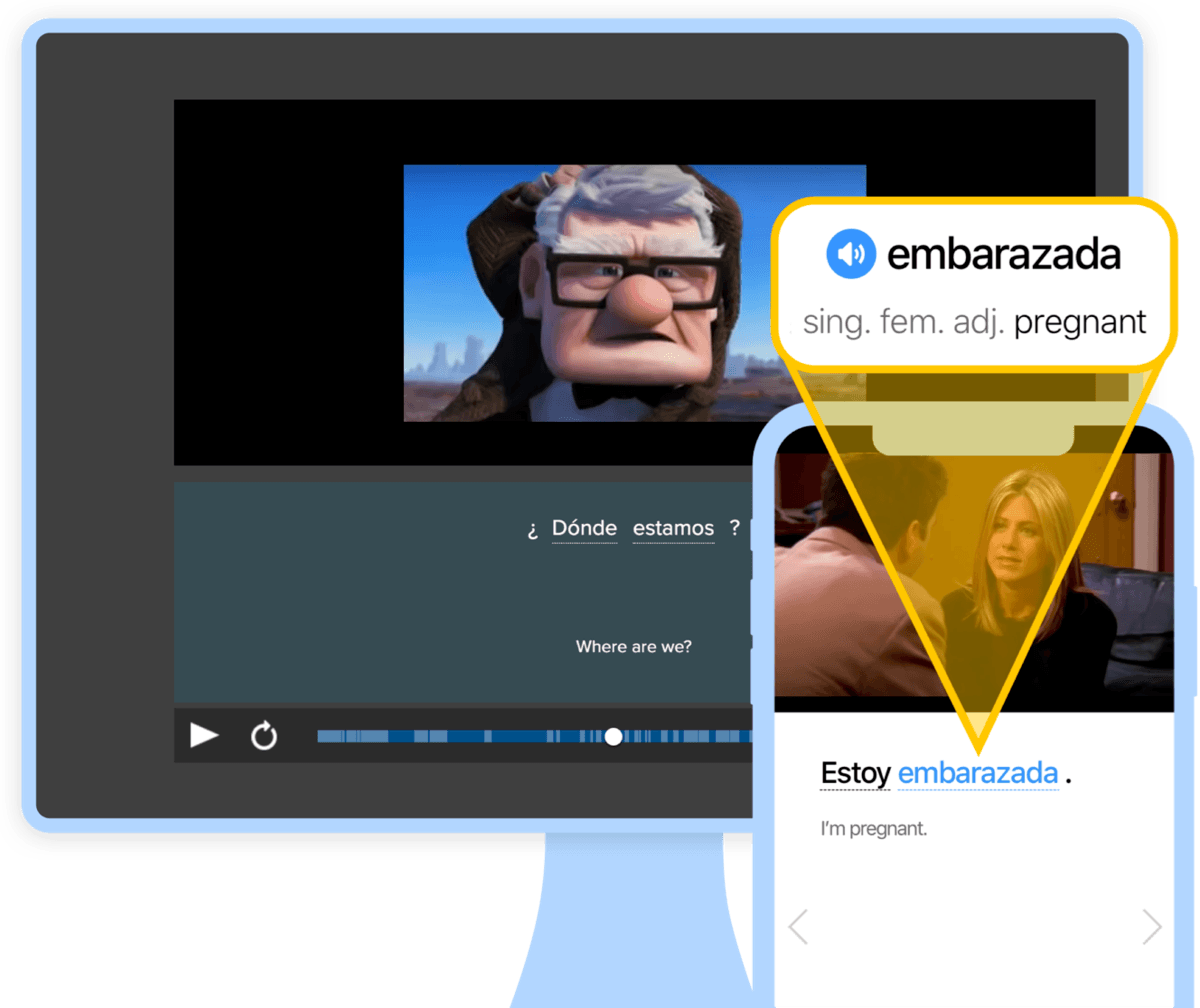

This real-world, in-context way of learning is very effective. It’s the principle behind FluentU—a language learning program that bases its English lessons on authentic video content, including clips from news reports and finance-oriented material. Each video comes with interactive subtitles—just click or tap a word in the subtitles for an instant definition, grammar info and useful examples. There are also flashcards and quizzes built into every video to ensure that you remember all the words you’ve learned.

The videos are conveniently organized by genre and difficulty. Just click “Business” and select your English level to find perfect relevant videos. FluentU will also keep track of what you’ve learned and suggest new videos based on that information.

The Top 20 Business English Words for Finance Topics You Must Know

To start you off, let me list 20 financial words that you’ll find useful. While these words often have other meanings not related to finance, I’ll only be discussing them in the financial context here.

1. Interest Rate

Interest is the amount the bank (or other moneylender, which is any person or organization that gives you money) will charge you or your company for the money you borrow from them. That amount, or interest rate, is expressed as a percentage of the loan.

As part of the loan repayment, you’ll have to repay the amount of the loan plus interest.

I would advise you to shop around for the best interest rate you can find before taking up that loan.

2. Investment

The noun investment refers to money that you put into your business, property, stock, etc., in order to make a profit or earn interest.

A great Reuters article said that “investment is drawn [attracted] to the UK because it provides a gateway [place of entry entry] to a single market of 500 million consumers.”

The word investment can also be used as an adjective. An investment destination refers to the location that businesses choose to place their investments in.

The article above also names the UK as the top investment destination within Europe.

3. External capital

The word external means outside. Capital refers to your money or assets. So, external capital refers to the money that a company receives from outside sources.

The use of external capital can help your company recover from the recent drop in sales performance.

4. Cash outflow

Cash outflow refers to the money that your company spends on its expenses and other business activities.

The key to surviving in business is to keep an eye on cash outflows and manage them well.

5. Revenue

Your revenue is the amount of money your company makes from the sale of goods and services.

The total sales revenue from our latest range of sports shoes is expected to top $1.5 million this year.

6. Profit

Profit describes the amount of revenue your company gains after excluding expenses, costs, taxes, etc. The goal of every business is to make profit.

Since we started advertising on the internet, our company’s profits have increased by 20% over the last year

7. Loss

In finance, we often hear the phrase profit and loss. Loss is when you lose money. It’s the opposite of profit, and it’s a word that no one in finance ever wants to hear. Still, it’s something that can happen when a company makes less money than it spends.

Since we decided to stop print advertising, our sales revenue has suffered a loss of 20% over the last year

8. Recession

When we talk about a recession, we’re referring to a period of significant (major) decline in a country’s economy that usually lasts months or years.

Bloomberg reports that the risk of a global recession is now more than 50 percent after the UK voted to leave the European Union.

9. Debt

Debt refers to any kind of borrowing such as loans, mortgages, etc. Debts are a way for you or your company to borrow money (usually for large purchases) and repay it at a later date with interest.

I think we should consider other options to fix our business rather than running into more debt.

10. Collateral

Collateral is something valuable, such as a property you own, that you pledge (temporarily give to) a bank, financial company or other moneylender as a guarantee of your loan repayment.

The moneylender will hold your collateral until your loan is completely paid in full. If you fail to make your loan payments, the bank will seize (take away) your property to recover their losses. This way, there’s no risk that they’ll lose the money they gave you.

If Mr. Jones intends to use his farm as collateral for his business loan, he will have to show proof of ownership to the bank.

11. Mortgage

A mortgage is a loan in which your property—most commonly your house—will be held by a bank or other moneylender as collateral. You’ll receive a loan for the value of the property. This means the moneylender will hold your property until your loan has been fully repaid.

It has been hard for the Quinns to keep up their mortgage payments since Mr Quinn lost his job.

12. Short-term loan

As a business or individual, you can borrow money from the bank for short periods of time. A short-term loan is usually repaid in less than five years.

BHS, a large retail chain, was charged a high interest rate for the short-term loan they took out in order to stay in business.

13. Long-term loan

Sometimes businesses need to buy assets, equipment, inventory and other things. Banks offer long-term loans for businesses that need to borrow a large amount of money for a longer period of time.

Long-term loans are generally repaid over a period of time that exceeds five years.

At the meeting, it was decided that the company would opt for (choose) a long-term loan that offers a lower interest rate.

14. Credit rating

The credit rating of a person or company is either a formal evaluation or an estimate of their credit history, and it indicates their potential ability to repay any new loans.

Banks and financial companies will usually check your credit rating before approving your loan.

We’re confident that our company’s loan application will be approved as we have a good credit rating.

15. Overdraft

An overdraft is when you spend more money than you have in your bank account. The bank will often make you pay an overdraft fee if you do this.

If you have an overdraft account, this simply means that your bank will allow you to continue withdrawing (taking out) money from you account, even when you don’t have available funds (enough money) in your account to cover your withdrawal amount.

There will still be some limits on how much you can overdraft, but having this special type of bank account means you don’t have to worry as much about those overdraft fees.

In a BBC news article, it was suggested that banks should warn customers before they go into overdraft and limit the overdraft fees that they charge.

16. Shares

Some companies divide their capital into shares and offer them for sale to create more capital for the company.

If you own shares in a company, you’re known as a shareholder. Each share you hold represents a unit of your ownership of the company.

Owning shares in a company doesn’t mean you have control over the day-to-day running of the business, but it does entitle (allow) you to receive a share of its profits.

Recent financial news say that Japanese shares are higher as investors regain their confidence across the region.

17. Stocks

The word stocks is a general term used to describe the ownership certificates of any company. The holder of a company’s stocks is a stockholder. As a stockholder, you’re entitled to a share of the company’s profit based on the number of stocks you hold.

Have you read the news that stocks are plunging all around the world shortly after the UK voted to leave the European Union?

18. Rally

As you know, stock markets go up and down. A stock market rally is when a large amount of money is entering the market and pushing stock prices up.

So, a rally is good news for investors, because it means that the market is recovering after being down.

Even though he doesn’t have money, it’s hard for him watch the stock market rally from afar without doing anything.

19. Bull market

Stop for a moment and picture a bull charging at an enemy—or even at you! Aggressive, right? Its horns are facing upwards, and they’re coming at you fast.

A bull market is a financial market situation where stock prices are up (just like the bull’s horns) as a result of investor confidence and the expectations of a strong market.

John’s job on Wall Street is even more hectic (busy) now that the bull market is in full swing.

20. Bear market

Now picture a bear as it tries to swipe (swing) its paws at its enemy, or you. It’s probably standing up and its paws are above you, moving downwards.

A bear market is the opposite of a bull market. In a bear market, stock prices are falling and the financial market is down—the bear’s paws are facing downwards, and coming down on its enemies.

While John’s friends are worried about a possible bear market, John is confident that the market will hold steady (remain good).

Well, it looks like we’re at the end of our list.

There’s lots of financial vocabulary out there that you can learn from financial news, articles and books.

Keep adding to this list as you go along.

Good luck!

Download: This blog post is available as a convenient and portable PDF that you can take anywhere. Click here to get a copy. (Download)

And One More Thing...

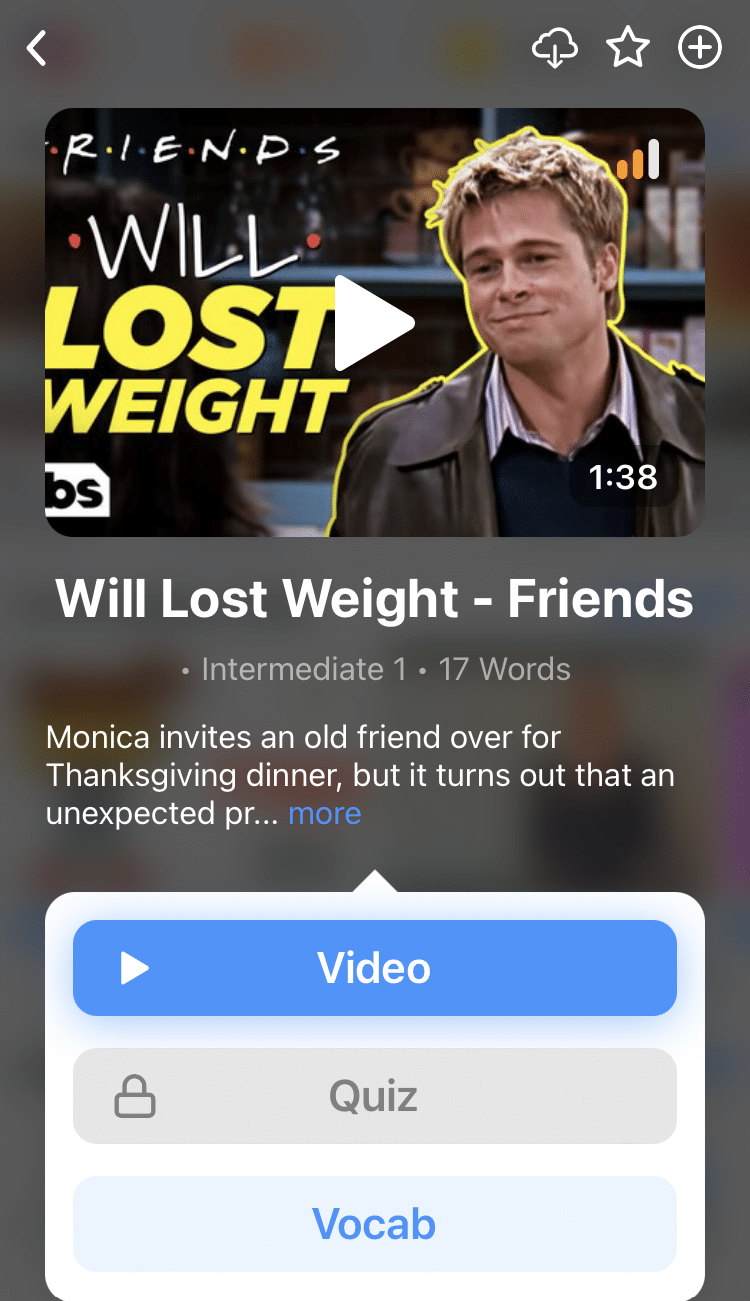

If you like learning English through movies and online media, you should also check out FluentU. FluentU lets you learn English from popular talk shows, catchy music videos and funny commercials, as you can see here:

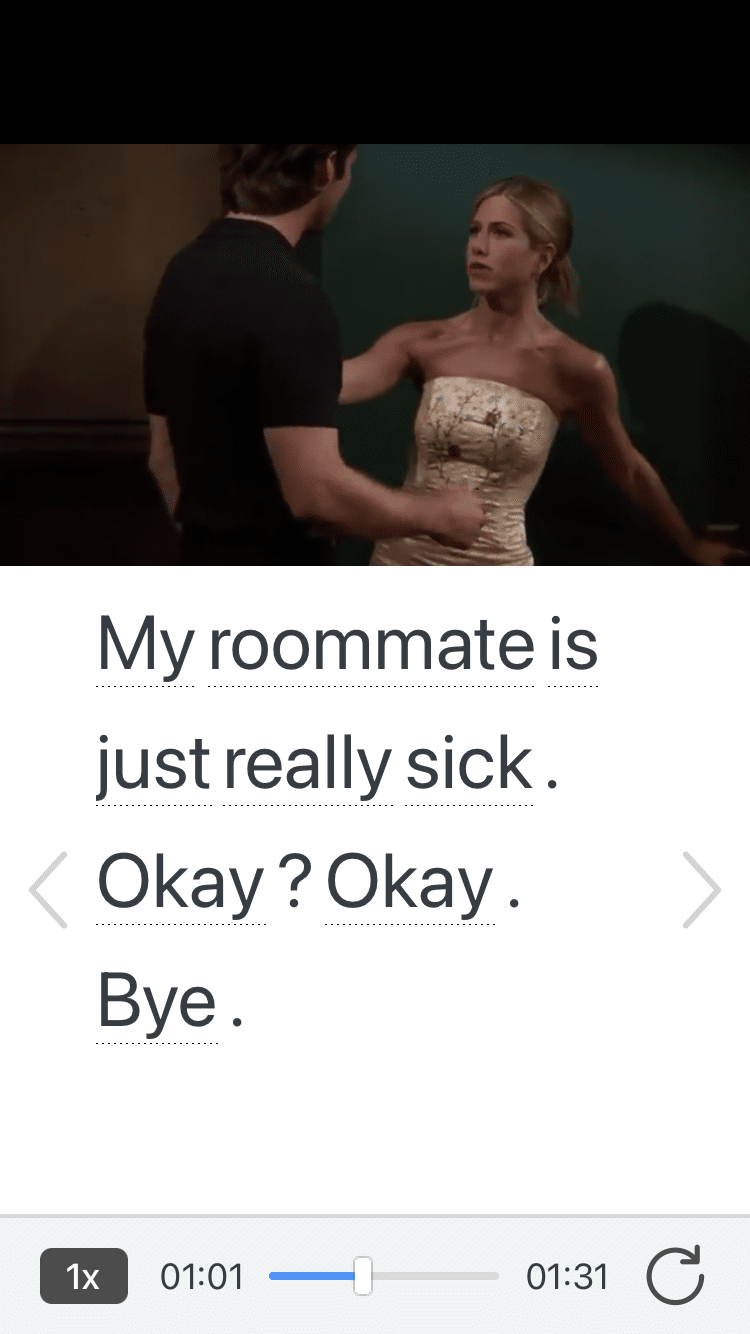

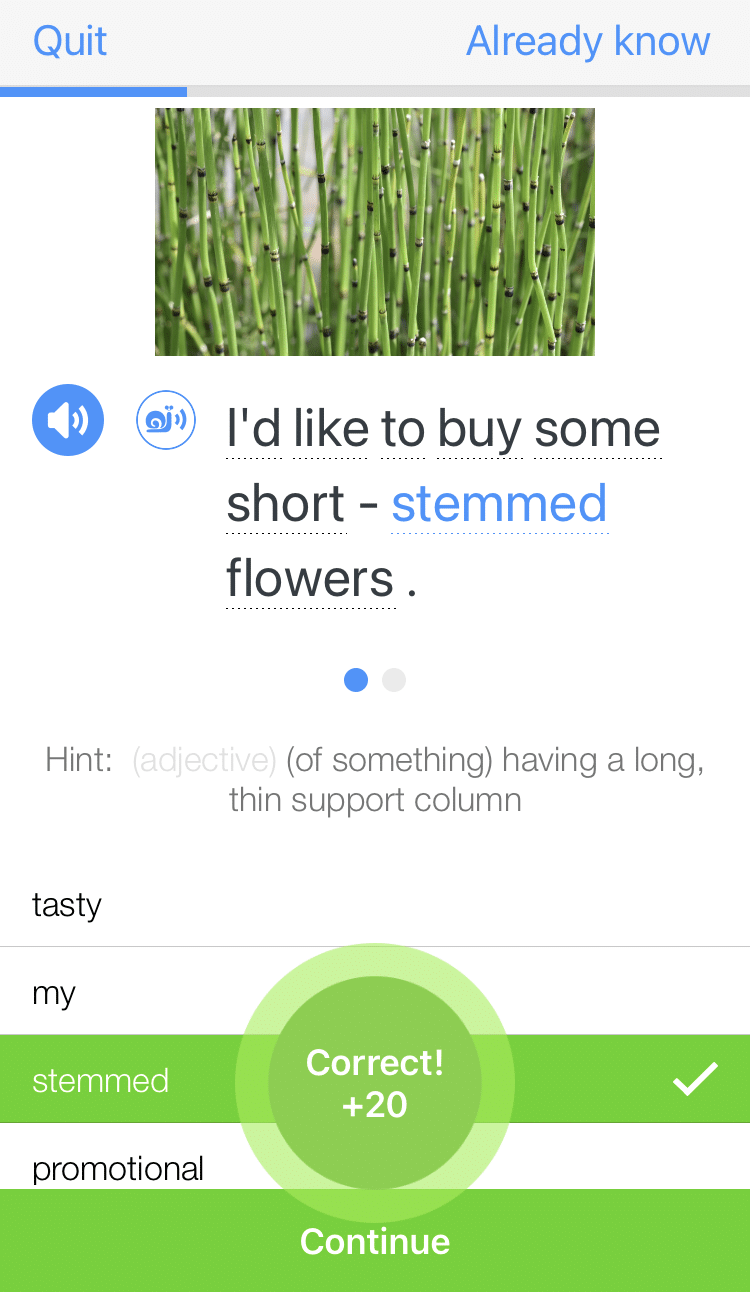

The FluentU app and website makes it really easy to watch English videos. There are captions that are interactive. That means you can tap on any word to see an image, definition, and useful examples.

For example, when you tap on the word "searching," you see this:

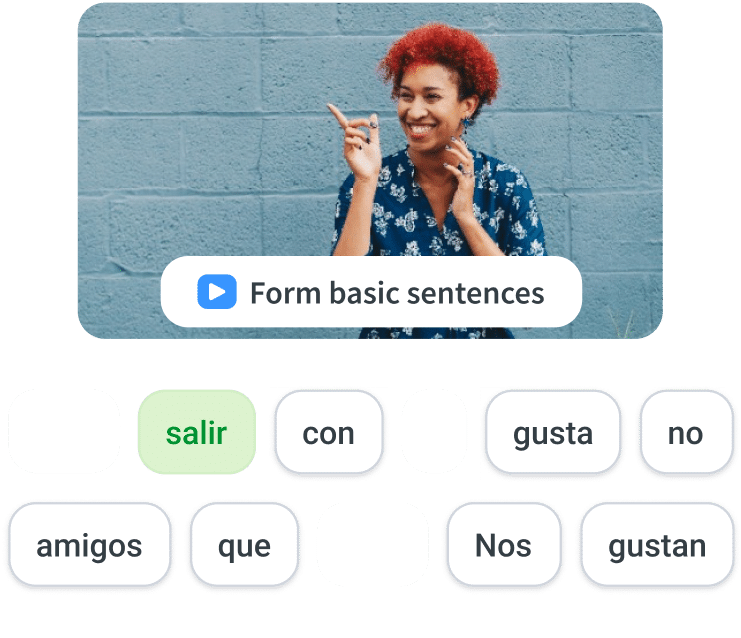

Learn all the vocabulary in any video with quizzes. Swipe left or right to see more examples for the word you’re learning.

FluentU helps you learn fast with useful questions and multiple examples. Learn more.

The best part? FluentU remembers the vocabulary that you’re learning. It gives you extra practice with difficult words—and reminds you when it’s time to review what you’ve learned. You have a truly personalized experience.

Start using the FluentU website on your computer or tablet or, better yet, download the FluentU app from the iTunes or Google Play store. Click here to take advantage of our current sale! (Expires at the end of this month.)